Last updated 8th July 2024

Final Results Presentation, 4th March 2024

Interim Results Presentation July 2023

Final Results Presentation, 27th February 2023

Interim Results Presentation, 27th July 2022

Final Results Presentation, 28th February 2022

Interim results presentations, 28th July 2021

Final results presentations, 1st March 2021

Interim results presentations, 28th July 2020

Final results presentations, 24th February 2020

Interim results presentations, 24th July 2019

Financial results presentations, 25th February 2019

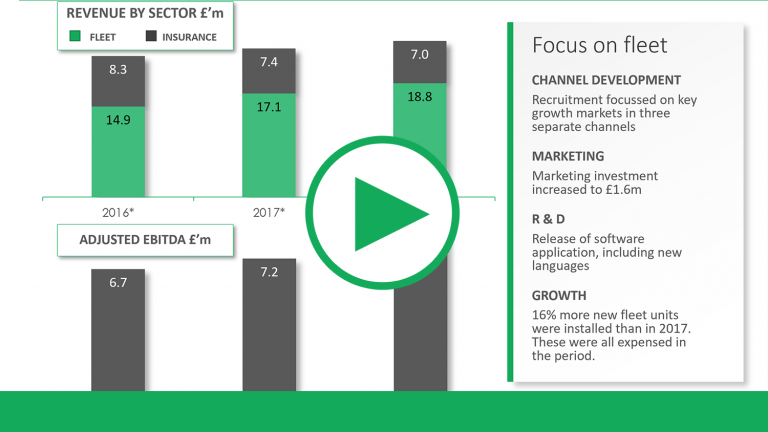

Interim results presentations, 25th July 2018

Financial results presentations, 26th February 2018

Interim results presentations, 26th July 2017

Financial results presentations, 27th February 2017

Interim results presentations, 27th July 2016

Financial results presentations, 29th February 2016

Final Results Presentation, 29 February 2016 Interim results presentations, 29th July 2015

- 8th July 2024 07:00 Quartix Technologies plc, Trading Statement

- 15th May 2024 18:24 Quartix Technologies plc, Granting of Options

- 27th March 2024 16:00 Quartix Technologies plc, Result of AGM

- 27th March 2024 07:00 Quartix Technologies plc, AGM Trading Statement and Directorate Change

- 4th March 2024 07:00 Quartix Technologies plc, Final Results

- 19th February 2024 07:00 Quartix Technologies plc Directorate Changes

- 24th January 2024 17:45 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 23rd January 2024 17:00 Quartix Technologies plc Director/PDMR Shareholding – Replacement

- 17th January 2024 15:51 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 17th January 2024 13:45 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 9th January 2024 07:00 Quartix Technologies plc Trading Statement

- 18th December 2023 11:45 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 11th December 2023 07:00 Quartix Technologies plc Konetik Update

- 28th November 2023 07:00 Quartix Technologies plc Directorate Changes

- 10th November 2023 16:00 Quartix Technologies plc PDMR Shareholding

- 11th October 2023 07:00 Quartix Technologies plc Board Changes – Correction

- 6th October 2023 07:00 Quartix Technologies plc Trading Update

- 26th September 2023 07:00 Quartix Technologies plc Directorate Change

- 21st September 2023 11:00 Quartix Technologies plc Director/PDMR Shareholding

- 15th September 2023 07:00 Quartix Technologies plc Acquisition of Konetik GmBH

- 3rd August 2023 15:50 Quartix Technologies plc Director/PDMR Shareholding

- 31st July 2023 07:00 Quartix Technologies plc Interim Results

- 10th July 2023 07:00 Quartix Technologies plc Interim Results Timetable and Trading Update

- 7th July 2023 07:00 Quartix Technologies plc Directorate Change

- 12th June 2023 13:45 Quartix Technologies plc PDMR Shareholding

- 28th March 2023 17:40 Quartix Technologies plc PDMR Shareholding

- 24th March 2023 18:05 Quartix Technologies plc Result of AGM

- 24th March 2023 07:09 Quartix Technologies plc Trading Statement

- 27th February 2023 07:00 Quartix Technologies plc Final Results

- 11th January 2023 07:00 Quartix Technologies plc Trading Statement

- 22nd December 2022 15:00 Quartix Technologies plc Surrender and Granting of Options

- 20th December 2022 14:30 Quartix Technologies plc Directorate Succession

- 6th December 2022 11:40 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 10th October 2022 07:04 Quartix Technologies plc Trading Update

- 9th September 2022 17:20 Quartix Technologies plc Standard form for notification of major holdings

- 1st August 2022 14:11 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 27th July 2022 07:00 Quartix Technologies plc Interim Results

- 11th July 2022 07:00 Quartix Technologies plc Interim Results Timetable and Trading Update

- 8th June 2022 15:45 Quartix Technologies plc PDMR Shareholding

- 7th June 2022 17:10 Quartix Technologies plc PDMR Shareholding

- 25th May 2022 13:10 Quartix Technologies plc Exercise of Share Options

- 26th April 2022 15:25 Quartix Technologies plc PDMR Shareholding

- 25th April 2022 13:10 Quartix Technologies plc PDMR Shareholding

- 20th April 2022 10:35 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 14th April 2022 10:40 Quartix Technologies plc PDMR Shareholding

- 7th April 2022 17:15 Quartix Technologies plc PDMR Shareholding

- 4th April 2022 15:55 Quartix Technologies plc PDMR Shareholding

- 23 March 2022 16:45 Quartix Technologies plc Result of AGM

- 23 March 2022 07:00 Quartix Technologies plc AGM Trading Statement

- 11 March 2022 17:00 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 28 February 2022 07:00 Quartix Technologies plc Final Results

- 2 February 2022 07:00 Quartix Technologies plc Award of London Stock Exchange Green Economy Mark

- 10 January 2022 07:00 Quartix Technologies plc Trading Update

- 22 October 2021 17:45 Quartix Technologies plc CEO Succession Update and Trading Update

- 21 October 2021 08:15 Quartix Technologies plc TR-1: Standard form for notification of major holdings

- 13 October 2021 07:00 Quartix Technologies plc CEO Succession Update and Trading Update

- 6 October 2021 17:30 Quartix Technologies plc Director/PDMR Shareholding

- 1 October 2021 17:15 Quartix Technologies plc Total Voting Rights

- 28 September 2021 14:15 Quartix Technologies plc Exercise of Options, Director Shareholding and TVR

- 20 September 2021 13:42 Quartix Technologies plc Standard form for notification of major holdings

- 23 August 2021 14:15 Quartix Technologies plc PDMR Shareholding

- 17 August 2021 17:35 Quartix Technologies plc PDMR Shareholding

- 12 August 2021 08:15 Quartix Technologies plc Exercise of Options, Director Shareholding and TVR

- 2 August 2021 07:00 Quartix Technologies plc PDMR Shareholding

- 28 July 2021 07:00 Quartix Technologies plc Interim Results

- 21 July 2021 07:00 Quartix Technologies plc Directorate Change

- 7 July 2021 07:00 Quartix Technologies plc Interim Results Timetable and Trading Update

- 1 July 2021 17:00 Quartix Technologies plc Total Voting Rights

- 23 June 2021 13:45 Quartix Technologies plc Exercise of Options, Director Shareholding & TVR

- 9 June 2021 09:01 Quartix Technologies plc Change of Name and Registered Address

- 27 May 2021 16:25 Quartix Holdings plc Exercise of Share Options, PDMR Shareholding & TVR

- 25 May 2021 07:56 Quartix Holdings plc Granting of Options

- 21 May 2021 07:00 Quartix Holdings plc Directorate Changes and Trading Update

- 26 March 2021 13:57 Quartix Holdings plc Exercise of Options, Director/PDMR Dealing & TVR

- 23 March 2021 14:56 Quartix Holdings plc Result of Annual General Meeting

- 23 March 2021 07:00 Quartix Holdings plc AGM Trading Statement

- 12 March 2021 13:34 Quartix Holdings plc Exercise of Options, Director/PDMR Dealing & TVR

- 4 March 2021 13:57 Quartix Holdings plc Exercise of share options and Total Voting Rights

- 3 March 2021 07:00 Quartix Holdings plc Dividend Timetable and Correction of Record Date

- 1 March 2021 07:00 Quartix Holdings plc Final Results

- 20 January 2021 11:24 Quartix Holdings plc Form for notification of major holdings

- 19 January 2021 11:24 Quartix Holdings plc Result of Secondary Placing

- 19 January 2021 07:00 Quartix Holdings plc Proposed Secondary Placing

- 11 January 2021 07:00 Quartix Holdings plc Trading Statement

- 6 January 2021 15:11 Quartix Holdings plc Notification of Major Holdings

- 22 October 2020 07:00 Quartix Holdings plc Trading Statement

- 24 September 2020 07:00 Exercise of Options and Total Voting Rights

- 28 July 2020 07:00 Quartix Holdings plc Interim Results

- 17 July 2020 07:00 Quartix Holdings plc Notice of Interim Results

- 2 June 2020 07:00 Quartix Holdings plc Trading Statement

- 27 April 2020 07:00 Quartix Holdings plc Trading Statement

- 30 March 2020 07:00 Quartix Holdings plc Director Share Transfers

- 25 March 2020 13:10 Quartix Holdings plc Result of Annual General Meeting

- 24 March 2020 12:35 Quartix Holdings plc Exercise of Options

- 24 March 2020 07:00 Quartix Holdings plc AGM Trading Statement

- 19 March 2020 07:00 Measures taken by Quartix re Coronavirus and Dividend

- 9 March 2020 15:47 PDMR share transfer

- 24 February 2020 7.00 Quartix Holdings plc Final Results

- 13 January 2020 7.00 Quartix Holdings plc Trading Statement

- 23 October 2019 7:00 Quartix Holdings plc Directorate Changes

- 24 July 2019 7:00 Quartix Holdings plc Interim Results

- 19 June 2019 7:00 Quartix Holdings plc Trading Update

- 14 May 2019 08:58 Quartix Holdings plc Director/PDMR Shareholding

- 10 May 2019 17:52 Quartix Holding(s) in Company

- 15 April 2019 Quartix Holdings plc Director Share Transfers

- 28 March 2019 Director/PDMR Shareholding

- 26 March 2019 Quartix Holdings plc Exercise of Options

- 26 March 2019 AGM Trading Statement

- 5 March 2019 07:00 Quartix Holding(s) in Company

- 25 February 2019 07:00 Quartix Holdings plc Full Year Results 2018

- 22 February 2019 07:00 Quartix Holdings plc Change of Registered Office

- 31 January 2019 14:04 Quartix Holding(s) in Company

- 30 January 2019 09:11 Quartix Holding(s) in Company

- 10 January 2019 07:00 Quartix Holdings plc Trading Statement

- 5 December 2018 07:00 Exercise and Granting of Options

- 4 December 2018 07:00 Quartix Holdings plc Trading Statement

- 4 October 2018 07:00 Board Update

- 13 August 2018 16:12 Exercise of Options

- 25 July 2018 07:00 Quartix Holdings Plc Interim Results

- 2 July 2018 07:00 Quartix Holdings Plc Trading Statement

- 26 April 2018 14:58 Director Share Transfer

- 23 April 2018 07:00 Queen’s Award for Enterprise

- 27 March 2018 14:46 Exercise of Options

- 27 March 2018 14:42 Result of AGM

- 27 March 2018 07:00 Trading Statement

- 12 March 2018 18:10 Director/PDMR Shareholding

- 26 February 2018 07:00 Quartix Holdings plc Full Year Results 2017

- 16 January 2018 17:33 Director/PDMR Shareholding

- 12 January 2018 07:00 Trading Statement

- 01 December 2017 13:29 Issue of Equity & Directorate Changes

- 10 November 2017 07:00 Holding(s) in Company

- 08 November 2017 15:26 Holding(s) in Company

- 27 September 2017 07:04 Directorate Change

- 01 August 2017 07:00 Director/PDMR Shareholding

- 26 July 2017 07:00 Directorate Changes

- 26 July 2017 07:00 Interim Results

- 03 July 2017 07:00 Trading Update

- 21 June 2017 07:00 Exercise of Options

- 18 April 2017 12:20 Director/PDMR Shareholding

- 13 April 2017 17:00 Holding(s) in Company

- 30 March 2017 12:20 Holding(s) in Company

- 30 March 2017 08:01 Holding(s) in Company

- 28 March 2017 13:20 Exercise of Options

- 28 March 2017 11:40 Result of AGM

- 28 March 2017 07:00 AGM Statement

- 09 March 2017 10:10 Exercise of Options and Total Voting Rights

- 02 March 2017 11:13 Director/PDMR Shareholding

- 27 February 2017 07:00 Quartix Holdings plc Full Year Results 2016

- 18 January 2017 07:00 Trading Statement

- 22 December 2016 13:41 Holding(s) in Company

- 15 September 2016 07:00 Holding(s) in Company

- 09 August 2016 09:13 Exercise of Options

- 05 August 2016 16:12 Holding(s) in Company

- 01 August 2016 09:43 PDMR Shareholding

- 27 July 2016 07:00 Interim Results

- 01 July 2016 07:00 Trading Update

- 19 April 2016 13:55 Director Share Transfer

- 04 April 2016 07:03 Holding(s) in Company

- 29 March 2016 12:16 Result of AGM

- 29 March 2016 07:00 AGM Statement

- 29 February 2016 13:42 Exercise of Options

- 29 February 2016 07:00 Quartix Holdings plc Full Year Results 2015

- 15 January 2016 07:00 Trading Statement

- 21 December 2015 07:00 Holding(s) in Company

- 17 December 2015 13:43 Exercise Of Warrants

- 27 October 2015 15:00 Adoption of Financial Reporting Standard (FRS) 101 – Reduced Disclosure Framework

- 23 October 2015 16:10 Holding(s) in Company

- 22 October 2015 15:35 Holding(s) in Company

- 21 October 2015 16:19 Holding(s) in Company

- 29 July 2015 07:00 Interim Results

- 03 July 2015 16:40 Exercise of Options and Total Voting Rights

- 01 July 2015 07:01 Trading Update

- 11 June 2015 15:58 Holding(s) in Company

- 30 April 2015 15:42 Director Share Transfer

- 16 April 2015 16:51 Result of AGM

- 10 April 2015 09:00 Change to Board of Directors and Trading Statement

- 07 April 2015 16:18 Exercise of Options and Total Voting Rights

- 04 March 2015 14:09 Director Share Transfer

- 03 March 2015 07:00 Quartix Holdings plc Full Year Results 2014

- 19 January 2015 07:00 Trading Statement & Results Timetable

- 08 December 2014 16:06 Director & PDMR Share Transfers

- 25 November 2014 15:17 Exercise of Options and Total Voting Rights

- 10 November 2014 11:48 Holding(s) in Company

- 07 November 2014 15:42 Holding(s) in Company

- 07 November 2014 13:11 Holding(s) in Company

Andy Walters

Executive Chairman

Andy Walters founded Quartix in 2001 with three colleagues. Prior to that he was Managing Director of a subsidiary of Spectris plc for 6 years and had spent 15 years with Schlumberger in the UK and France, where he was marketing director of the payphones and smart cards division. Andy holds an MA in electrical sciences from the University of Cambridge.

Alison Seekings

Independent Non-Executive Director and Audit Chair

Alison is a senior finance leader with extensive experience of working at board level. Alison is a qualified chartered accountant and chartered tax adviser and has a degree in Natural Sciences from the University of Cambridge. She has worked in large professional services firms, formerly with Deloitte and then as a partner with Grant Thornton UK LLP until 2021. Alison has over 30 years’ experience of advising boards and supporting companies with their financial strategy and reporting requirements.

Ian Spence

Independent Non-Executive Director and Chair of the Nomination Committee

Ian has more than 25 years' experience in researching and advising companies in the technology sector. He is the Executive Chairman and Founder of Megabuyte, a leading company intelligence platform focusing on UK mid-market tech businesses. Recognised as a highly respected financial analyst in the technology sector, Ian has twice been voted as TechMARK Analyst of the Year and recognised by Debretts and The Sunday Times as a top 20 influencer in the UK technology sector. Additionally, he holds roles as a Non-Executive Director at Crown Place VCT PLC, investing in early-stage tech companies, and as Principal at Agnosco Capital Ltd, offering strategic advice to technology companies and investors.

The following information is provided in compliance with Rule 26 of the AIM (Alternative Investment Market) Rules for listed Companies.

Name: Quartix Technologies plc

Registered Office: No.9 Journey Campus, Castle Park, Cambridge, CB3 0AX

Registration: Incorporated and registered in England and Wales company registration number 06395159

Main Country of Operation: United Kingdom

Principal Other Countries Of Operation: France, United States of America

VAT Number: GB 918 4938 83

The business is subject to The UK Takeover Code.

Quartix Technologies PLC is a holding company for;

- Quartix Ltd (UK Co No: 04159907),

- Quartix Inc (registered in the State of Illinois, no 6903-987-1)

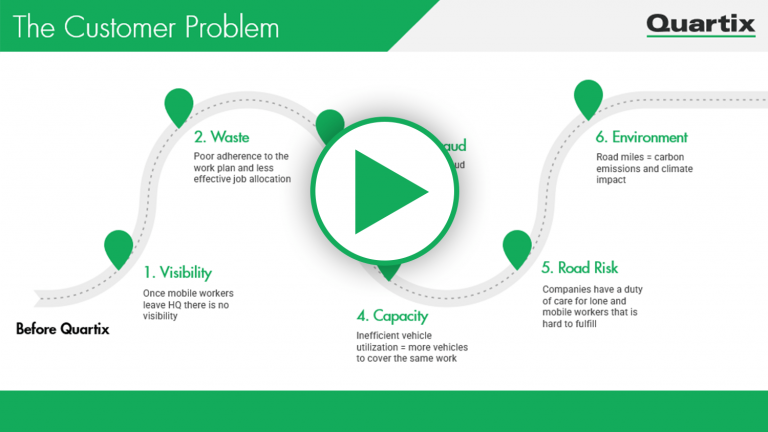

Founded in 2001, Quartix is a leading supplier of subscription-based vehicle tracking systems, software and services in the UK. The Group provides an integrated tracking and telematics data analysis solution for fleets of commercial vehicles and “pay as you drive” motor insurance providers that is designed to improve productivity and lower costs by capturing, analysing and reporting vehicle and driver data.

Quartix’s vehicle tracking systems, which incorporate instrumentation to identify and transmit location, speed and acceleration data to the Group on a real-time basis, can be installed in a wide range of vehicles. The Group’s proprietary vehicle tracking software system provides business critical reporting and analysis of vehicle and driver data including timesheets and other customer KPIs to customers via any internet-enabled device. Vehicle tracking systems can either be purchased by the customer outright or rented on a monthly basis with no up-front cost and pricing is based on the level of functionality required.

As tracking technology and telematic data analysis have advanced, the functionality of vehicle tracking systems has increased making them more attractive and cost effective for end use customers. Consequently, the addressable markets in both the commercial fleet and telematics-based insurance sectors are anticipated to grow substantially over the medium term. The Berg Insight Report anticipates that the number of fleet management systems in active use will grow at an annual rate of 16 per cent. between 2012 and 2017 in Europe. The Group operates an effective, low cost remote sales model, based on direct telephone marketing and indirect sales including the use of price comparison websites and distribution networks, making it well positioned to grow both in the UK and internationally.

- Quartix Technologies plc, Financial Statements 2023

- Quartix Technologies plc, Interim Report 31 July 2023

- Quartix Technologies plc, Financial Statements 2022

- Quartix Technologies plc, Interim Report 27 July 2022

- Quartix Technologies plc, Financial Statements 2021

- Quartix Technologies plc, Interim Report 30 June 2021

- Quartix Holdings plc, Financial Statements 2020

- Quartix Holdings plc, Interim Report 30 June 2020

- Quartix Holdings plc, Financial Statements 2019

- Quartix Holdings plc, Interim Report 30 June 2019

- Quartix Holdings plc, Financial Statements 2018

- Quartix Holdings plc, Interim Report 30 June 2018

- Quartix Holdings plc, Financial Statements 2017

- Quartix Holdings plc, Interim Report 30 June 2017

- Quartix Holdings plc, Financial Statements 2016

- Quartix Holdings plc, Interim Report 30 June 2016

- Quartix Holdings plc, Financial Statements 2015

- Quartix Holdings plc, Interim Report 30 June 2015

- Quartix Holdings plc, Financial Statements 2014

- Quartix Holdings plc, Interim Report 30 June 2014

- Quartix Holdings Ltd, Financial Statements 2013

Quick links:

COMPANY, MARKET AND BACKGROUND

What are the origins of the company, and where did the name Quartix come from?

Four founders started the company in 2001 to focus on the market for vehicle tracking systems, software and services used by the commercial fleet sector. Our target market was then, as it is now, small to medium-sized fleets of light commercial vehicles. The name “Quartix” was the suggestion of one of the founders, for which the URL staging.quartix.net and www.quartix.co.uk were available. We purchased both www.quartix.com and www.quartix.fr and other Quartix domains more recently.

What do you estimate your market share to be?

We believe that of the 3.6 million+ commercial vehicles in the UK, roughly 3 million of these are light commercial vehicles (i.e. vans) and that approximately half of these are operated by fleets which would be a potential target for our technology. Of these 1.5 million vehicles, we estimate that around one third are already equipped with some form of fleet management or vehicle tracking system, and that therefore (with a subscription base of around 100,000 units in the UK) we have around 20% of the current market.

Who are your biggest competitors in the UK, France and USA? How do you compare with them?

Other companies which compete in this market include, inter alia: TomTom, Masternaut, Fleetmatics and Teletrac. We do not comment on their, or our, relative competitive strengths and weaknesses.

In July 2016 Quartix announced an intention to focus more on its fleet operation. How does this impact on insurance operations?

The Group will concentrate its business development activities in insurance on those opportunities which make best use of the significant technological and service advantages that the Group has. The insurance capabilities of the system can be seen at staging.quartix.net/insurance.

The company appears to command higher margins than many of its competitors. Why is this?

Our typical service charges are shown on our website, and these charges reflect the value of the software and services that we provide for our customers. Ongoing marginal costs for these are accounted for by the SIM card and mapping costs. The fleet tracking business, once the equipment and installation costs are absorbed, is therefore inherently high margin, reflecting the investment that we make in our software systems. We write all equipment and installation costs down immediately following installation.

The company is especially associated with the building, maintenance and construction industries so would you call it a cyclical company?

To some degree, yes, but this did not affect us unduly in the last recession, and we now have a broader spread of customers, including many from the public sector.

Is the fact that you are spread over four locations not a problem for you? Do you have any future plans to consolidate them all in one place?

We operate common VPNs, database systems and CRM and other business applications across each of our 4 UK sites and our Chicago office. We have recently introduced a common VOIP phone system across our operations. Communication and collaboration across functions and locations is extremely good. In addition to this, each of our R&D locations has a specific area of responsibility, as follows:

- Telematics hardware, firmware and communications servers are developed in Cambridge.

- All our web-based user applications and reporting are developed in Leatherhead

- Systems, networking and database design are all conducted in Bishop’s Waltham.

- Our sales, logistics, customer support, administration and insurance telematics teams are based at our main office centre in Newtown, Mid-Wales.

- Each of these teams works effectively with the others and we have no plans to consolidate these operations.

How do you plan to prepare for the introduction of General Data Protection Regulation (GDPR) in May 2018?

Quartix is working with suppliers and partners to ensure that we continue to be compliant with all regulations including GDPR.

PRODUCT AND TECHNOLOGY

How big is the risk to your business of emerging disruptive technologies (i.e. using mobile phones for tracking)?

We constantly monitor the potential risks posed by both OEM –fitted technology and by the use of smart phones in vehicle tracking. Our current opinion on these matters are as follows:

- OEM-fitted technology: our customers typically choose a single software solution and reporting tool to cover their whole fleet, regardless of vehicle manufacturer, type or age. Although it is quite common for vehicle manufacturers to offer some form of telematics solution for its own products, these devices and software do not generally interface with those provided by other vehicle manufacturers.

- Mobile phone applications: whilst these undoubtedly have a place in segments of the market, most of our customers use the tracking system to regulate overtime and manage their mobile workforces. They expect the system to be tamper-proof, and for it to record every movement and journey that the vehicle makes. This is simply impractical with a mobile phone, as it could easily be left at home or switched off, or become discharged (the use of GPS increases battery drain).

Investors must, however, form their own opinions and conduct their own research in order to satisfy themselves regarding the level of risk associated with investing in Quartix.

Why can I not simply buy a tracker device from Amazon, or use another company’s software with your tracking system?

The link between our tracking systems and our communications servers is encoded using our own, proprietary, protocol. We registered a patent for this protocol soon after the foundation of the company. For security reasons it would not be possible for other applications to interpret and use this data without detailed technical information from us. Similarly it is not possible to purchase and use a GPS tracking system without an appropriate fleet management software application which is compatible with the tracking system.

Is there anything unique in the company’s database systems and other intellectual property. How important are these to the success of the company?

We use enterprise level database systems and whilst there is no single aspect of the design of our databases which is unique, we derive substantial competitive advantage from the use of our proprietary database systems integrated with best-in-class CRM and marketing automation systems.

All intellectual property in the company’s telematics hardware, firmware, server software, database systems and application software is proprietary to Quartix, and is of great importance to the success and profitability of the company.

Can you monetise the Safe Speed Database ?

The Company’s “Powered by Quartix” initiative for the insurance sector, which it launched at the middle of last year, offers insurance brokers an off-the-shelf telematics product allowing them to compete effectively in the young driver market. The SafeSpeed database is unique in comparing the behaviour of young drivers on particularly dangerous roads (such as single-carriageway rural roads) with that of more experienced fleet drivers on exactly the same road, helping to identify and coach those who are at risk of accident. Loss ratios on the first programme to use it have been very good so far.

FINANCIAL QUESTIONS

Executive salaries and benefits appear to be low in relation to other quoted companies. Why is this so and is it likely to change?

Executives on both the plc and operations board have traditionally received the same annual pay review as all other employees. Each executive has either an equity stake in the business (through their own investment) or share options.

What is your option granting policy going forward in terms of the annual % of number of shares? Is there a maximum cap on total outstanding options?

Current options outstanding amount to less than 5% of the share capital. The company will continue to grant options to employees and managers in order to retain, motivate and incentivise them, but it is not envisaged that this would result in any significant dilution for existing shareholders.

What does the goodwill shown on the balance sheet relate to?

Please see the following link for more details: http://www.logisticsit.com/articles/2008/02/01/3355-quartix-takes-the-next-step-forward-with-bank-of

Can you provide historical numbers for sales, profits etc?

| £m | 2011 | 2012 | 2013 | 2014* | 2015 | 2016 |

|---|---|---|---|---|---|---|

| Revenue | 6.7 | 8.3 | 13.2 | 15.3 | 19.7 | 23.3 |

| Operating Profit | 1.8 | 2.9 | 4.7 | 4.9 | 6.0 | 6.5 |

| PBT | 1.5 | 2.8 | 4.6 | 4.8 | 6.0 | 6.5 |

* Note: adjusted to exclude exceptional gain of £0.25m in 2014

What is your expected mid-term (five to ten years) growth rate?

Unfortunately we are unable to comment on or offer a prediction of our future growth rates.

We can say that we are seeking sustainably superior financial performance, in terms of:

- Organic fleet revenue growth

- Return on sales

- Gross margin

- Free cash flow conversion

- Recurring revenues /sales

- Revenue per head

Major shareholdings

The following information is correct as of 31 March 2024.

The Company’s issued share capital comprises 48,392,178 ordinary shares, each with a nominal value of £0.01. Each share has equal voting rights.

The number of the Company’s securities not in public hands is: 11,123,140 ordinary shares representing 22.99% of the issued share capital.

The Company has been notified of the following significant shareholders. Significant shareholders are those holding 3% or more of the shares in issue.

| Name | Number of shares | Percentage (%) |

|---|---|---|

| Andrew John Walters* | 10,861,609 | 22.44% |

| Liontrust Investment Partners LLP | 5,796,653 | 11.98% |

| Charles Stanley Group plc | 4,620,800 | 9.55% |

| Sanford Deland Asset Management Ltd | 4,590,000 | 9.49% |

| Andrew Martin Kirk | 4,009,853 | 8.29% |

| William Arthur Hibbert | 2,663,000 | 5.50% |

| Schroders PLC | 2,497,631 | 5.16% |

| Kenneth Vincent Giles | 1,871,800 | 3.87% |

*Includes shares held as family interests or by virtue of position as beneficiary or potential beneficiary of certain trusts.

RESTRICTIONS

There are no restrictions on the transfer of the Company’s AIM securities.

OTHER EXCHANGES AND TRADING PLATFORMS

The Company has not applied or agreed to have its securities admitted to or traded on any other exchange or trading platform.

NOMINATED ADVISOR AND BROKER

Cavendish Capital Markets Ltd

Address: One Bartholomew Close, London, EC1A 7BL

Website: www.cavendish.com

COMPANY AUDITORS

PKF Littlejohn LLP

Address: 15 Westferry Circus, London E14 4HD, United Kingdom

Website: https://www.pkf-l.com/

LEGAL ADVISORS

HCR Hewitsons LLP

Address: Shakespeare House, 42 Newmarket Rd, Cambridge CB5 8EP.

Website: www.hewitsons.com

REGISTRARS

Link Group

Address: Link Group, Central Square, 29 Wellington Street, Leeds, LS1 4DL

Website: www.linkgroup.eu

Link Group – Shareholder information

Corporate Governance AIM Notice 50

Last updated on 21 February 2024

Chairman’s Corporate Governance Statement

All members of the Board believe strongly in the value and importance of good corporate governance and in our accountability to all of Quartix’s stakeholders, including shareholders, staff, customers and suppliers. In the statement below, we explain our approach to governance, and how the Board and its committees operate.

The corporate governance framework which the Group operates, including board leadership and effectiveness, board remuneration, and internal control is based upon practices which the Board believes are appropriate for the size, risks, complexity and operations of the business and is reflective of the Group’s values. Of the two widely recognised formal codes, we have therefore decided to adhere to the Quoted Companies Alliance’s (QCA) Corporate Governance Code for small and mid-size quoted companies (revised in April 2018 to meet the new requirements of AIM Rule 26). In November 2023 a revised QCA code was released, which Quartix has not considered in this Annual Report but will apply in the current accounting period in line with the guidance set out by the QCA.

The QCA Code is constructed around ten broad principles and a set of disclosures. The QCA has stated what it considers to be appropriate arrangements for growing companies and asks companies to provide an explanation about how they are meeting the principles through the prescribed disclosures. We have considered how we apply each principle to the extent that the Board judges these to be appropriate in the circumstances, and below we provide an explanation of the approach taken in relation to each. The Board considers that it has complied with the principles of the QCA Code.

Roles and responsibilities of Chairman

Paul Boughton resigned from his position as Non-Executive Chairman on 25 September 2023, and Andrew Walters was appointed as Chairman on 26 September 2023. The Chairman is responsible for running the Board and ultimately for all corporate governance matters affecting the Group.

The Chairman is responsible for leadership of the Board, setting its agenda and monitoring its effectiveness. He ensures effective communication with shareholders and that the Board is aware of the views of major shareholders. He ensures that the Executive Team develop a strategy which is supported by the Board as a whole. The Executive Team are responsible for executing the strategy once agreed by the Board.

Board composition and compliance

The QCA Code requires that the boards of AIM companies have an appropriate balance between Executive and Non-Executive Directors of which at least two should be independent. Throughout the majority of 2023 we satisfied this requirement, although the board changes announced later in the year meant that in February 2024 a second independent Non-Executive Director was appointed to increase the number of Non-Executive Directors from one to two.

The Independent Non-Executive Directors bring wide and varied commercial experience to the Board and Committee deliberations. They are appointed for an initial three-year term, subject to election by shareholders at the first AGM after their appointment, after which their appointment may be extended subject to mutual agreement and shareholder approval. A Non-Executive Director is typically expected to serve two three-year terms but may be invited by the Board to serve for an additional period. Any term renewal is subject to Board review and AGM re-election. The Company remains committed to a Board which has a balanced representation of Executives and Non-Executives.

Board evaluation

We support the QCA Code’s principle to review regularly the effectiveness of the Board’s performance as a unit, as well as that of its committees and individual Directors, and completed the last review in 2022. We may consider the use of external facilitators in future board evaluations.

Shareholder engagement

We have made significant efforts to ensure effective engagement with both institutional and private shareholders. In addition to the AGM, we have roadshows with investors and prospective investors to not only share our financial results, but also to share the leadership’s future plans and strategy in an open and interactive forum.

The Board is aware that following the introduction of the Markets in Financial Instruments Directive II (MiFID II) regulations at the start of 2018, private investor access to research on public companies has been restricted. We have not yet commissioned any “paid for” research from third party analysts and have no current intention of doing so.

The Board has ultimate responsibility for reviewing and approving the Annual Report and Accounts and it has considered and endorsed the arrangements for their preparation, under the guidance of its audit committee. The Directors confirm that the Annual Report and Accounts, taken as a whole, is fair, balanced and understandable and provides the information necessary for shareholders to assess the Group’s position and performance, business model and strategy.

10 Principles of the QCA Code:

- Establish a strategy and business model which promote long-term value for shareholders

- Seek to understand and meet shareholder needs and expectations

- Take into account wider stakeholder and social responsibilities and their implications for long-term success

- Embed effective risk management, considering both opportunities and threats, throughout the organisation

- Maintain the Board as a well-functioning, balanced team led by the chair

- Ensure that between them the Directors have the necessary up-to-date experience, skills and capabilities

- Evaluate board performance based on clear and relevant objectives, seeking continuous improvement

- Promote a corporate culture that is based on ethical values and behaviours

- Maintain governance structures and processes that are fit for purpose and support good decision-making by the Board

- Communicate how the Company is governed and is performing by maintaining a dialogue with shareholders and other relevant stakeholders

1. ESTABLISH A STRATEGY AND BUSINESS MODEL WHICH PROMOTE LONG-TERM VALUE FOR SHAREHOLDERS

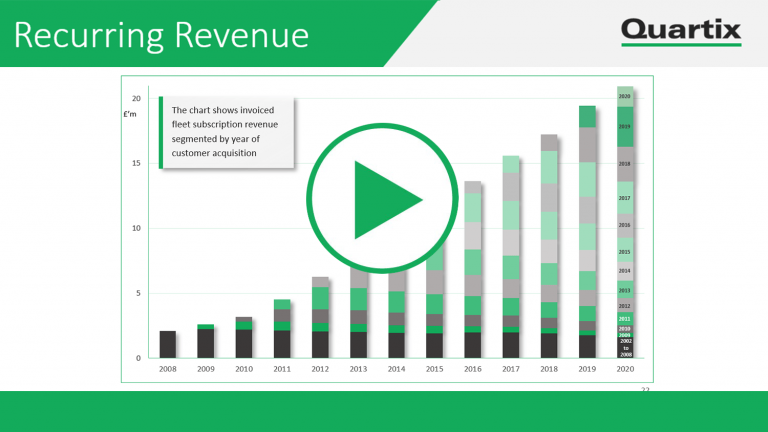

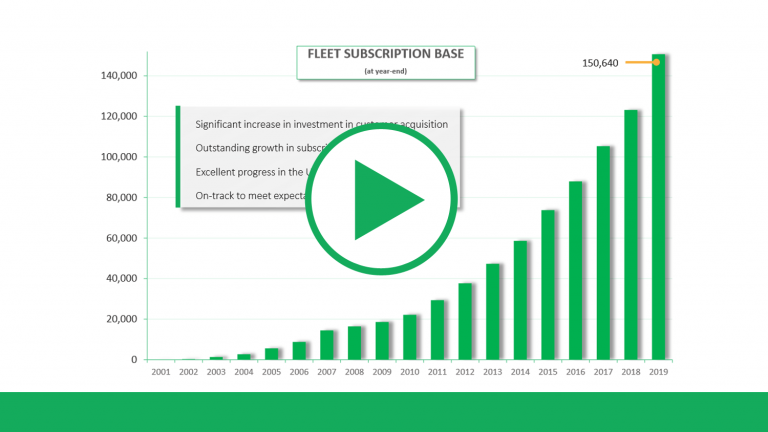

The Group’s main strategic objective is to grow its fleet business and develop the associated recurring revenue by increasing the number of vehicles under subscription.

The value of recurring subscription revenue is the key measure of our performance in the fleet sector.

Fleet customers typically use the Group’s vehicle telematics services for many years, resulting in low rates of gross attrition. Accordingly, the Group focuses its business model on the development of subscription revenue based on minimal initial commitment from the customer, providing the best return to the Group over the long term.

The key risks and uncertainties we face are included under the Strategic Report: Financial Review.

2. SEEK TO UNDERSTAND AND MEET SHAREHOLDER NEEDS AND EXPECTATIONS

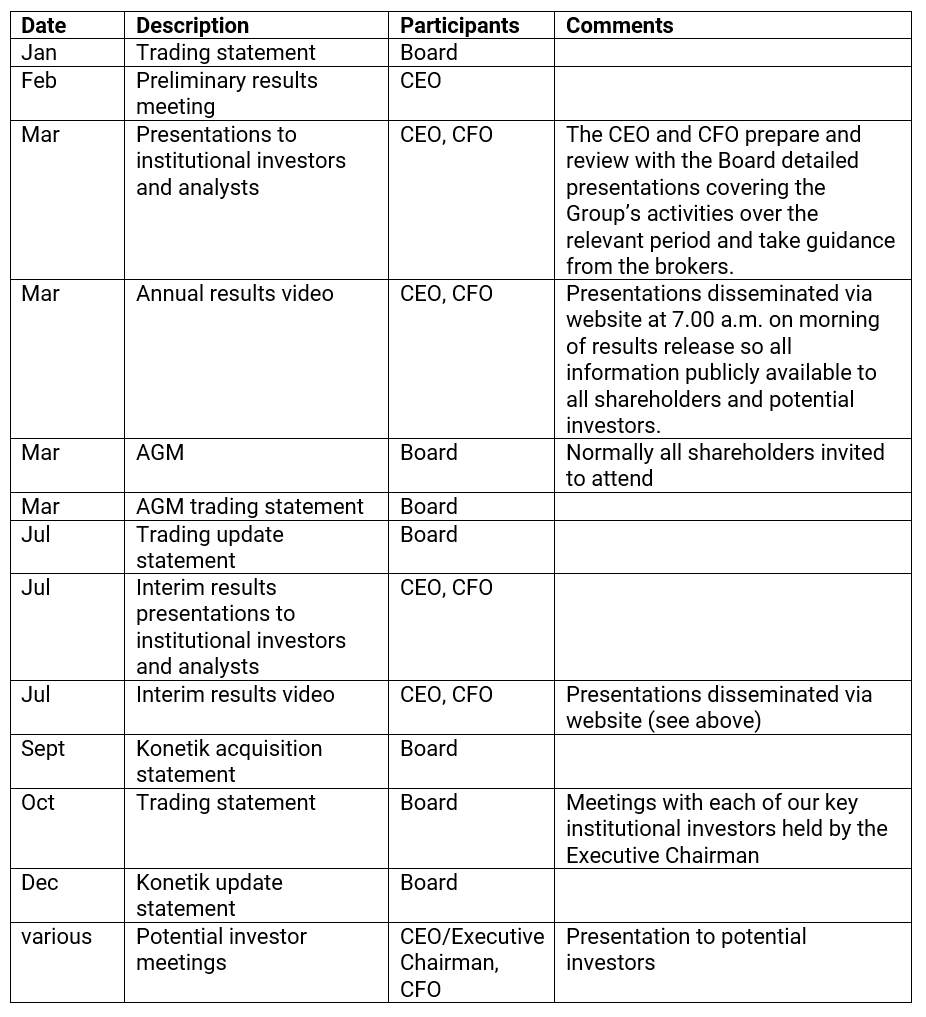

Responsibility for investor relations rests with the CEO/Executive Chairman, supported by the CFO. During 2023 the following activities were pursued to develop a good understanding of the needs and expectations of all constituents of the Group’s shareholder base:

Key: CEO: Chief Executive Officer, CFO: Chief Financial Officer.

The Group is committed to communicating openly with its shareholders to ensure that its strategy and performance are clearly understood. As illustrated in the table above, we communicate with shareholders throughout the year by various formats. A range of corporate information (including all Quartix announcements) is also available to shareholders, investors and the public on our website.

Private shareholders: The AGM is the principal forum for dialogue with private shareholders and normally the Board invite all shareholders to attend and participate. The Notice of Meeting is sent to shareholders at least 21 days before the meeting. The chairs of the Board and all committees, together with all other Directors, attend the AGM and are available to answer questions raised by shareholders. Shareholders vote on each resolution and subsequently publish the outcomes on our website.

Institutional shareholders: The Directors actively seek to build a mutual understanding of objectives with institutional shareholders. Our CEO/Executive Chairman and CFO make presentations to institutional shareholders and analysts immediately following the release of the full-year and half-year results. We communicate with institutional investors frequently through formal meetings. The majority of meetings with shareholders and potential investors are arranged by the broking team within the Group’s nominated advisor. Following meetings, the broker provides anonymised feedback to the Board from all fund managers met, from which sentiments, expectations and intentions may be gleaned. In addition, we review analysts’ notes to achieve a wide understanding of investors’ views. This information is considered by the Board

3. TAKE INTO ACCOUNT WIDER STAKEHOLDER AND SOCIAL RESPONSIBILITIES AND THEIR IMPLICATIONS FOR LONG-TERM SUCCESS

Staff – our ability to fulfil customer requirements and execute our strategy relies on having talented and motivated staff.

Reason for engagement: Good two-way communication with staff is a key requirement for high levels of engagement.

How we engage:

- Weekly update communication.

- Regular staff briefings via video presentation during 2023.

- A Q3 Group wide overnight event was held at the main UK office.

- Annual engagement survey through Investors in Customers.

These have provided insights that have led to enhancement of management practices and staff incentives.

Customers – our success and competitive advantage are dependent upon fulfilling customer requirements, particularly in relation to quality of service and report reliability.

Reason for engagement: Longevity of customer relationships is a key part of our strategy.

Understanding current and emerging requirements of customers enables us to develop new and enhanced services, together with software to support the fulfilment of those services. During 2022, Quartix secured the Investor in Customers (IIC) Gold accreditation, demonstrating its commitment to deliver high standards of customer service. IIC reviews customer experience by conducting a third-party, wide-scale survey to examine how well a business listens and responds to customer needs.

How we engage:

- Seek feedback on services and software systems.

- Develop tools and reports to enable our customers to analyse driver behaviour.

- Obtain feedback to use in the development of future service.

- A Leadership Adoption Plan was introduced in 2022 where all senior management in the business have direct relationships with some of Quartix’s larger customers to gain first-hand knowledge of their comments and concerns.

Suppliers – We have a range of suppliers including those who provide us with hardware, communication services, installation services and marketing support.

Reason for engagement: Good services from our suppliers are critical to us delivering the data services to our customers.

How we engage:

- Co-ordinate and manage our network of installers to ensure on-time activation of tracking devices.

- Operate systems to ensure that supplier invoices are processed and paid on time.

Shareholders – as a public company we must provide transparent, easy-to-understand and balanced information to ensure support and confidence.

Reason for engagement: Meeting regulatory requirements and understanding shareholder sentiments on the business, its prospects and performance of management.

How we engage:

- Regulatory news releases.

- Keeping the investor relations section of the website up to date.

- Publish videos of investor presentations and interviews.

- Annual and half-year reports and presentations.

We believe we successfully engaged with our shareholders over the past 12 months.

4. EMBED EFFECTIVE RISK MANAGEMENT, CONSIDERING BOTH OPPORTUNITIES AND THREATS, THROUGHOUT THE ORGANISATION

The Group has a risk register that identifies key risks and all members of the Board are provided with a copy of the register. The register, including control mechanisms to mitigate risks, is reviewed bi-annually by the Board and is updated following each such review.

The key risks and uncertainties are included in the Strategic Report: Financial Review.

Staff are reminded on appointment and on a bi-annual basis that they should seek approval from the CFO if they, or their families, plan to trade in the Group’s equities.

5. MAINTAIN THE BOARD AS A WELL-FUNCTIONING, BALANCED TEAM LED BY THE CHAIR

The members of the Board have a collective responsibility and legal obligation to promote the interests of the Group and are collectively responsible for defining corporate governance arrangements. Ultimate responsibility for the quality of, and approach to, corporate governance lies with the chair of the Board.

For the majority of 2023, the Board consisted of three Executive and three independent Non-Executives. The following plc Board changes took place in 2023:

- Laura Seffino stepped down from her position as an Executive Director in July 2023;

- in September 2023 the previous Chairman, Paul Boughton resigned;

- in October 2023 Richard Lilwall the previous CEO resigned;

- in September 2023, Andrew Walters one of the founders of the business re-joined the plc Board after retiring in March 2023;

- in November 2023 the two independent directors, Jim Warwick and Russell Jones resigned; and finally

- in November 2023, the Board announced the appointment of an independent Non-Executive Director, Alison Seekings.

In February 2024 the nominations committee appointed Ian Spence, a second independent Non-Executive Director, to achieve an equally balanced Board of 2 Executive Directors and 2 Non-Executive Directors. The Board is supported by four committees: audit, remuneration, nominations and, newly appointed, ESG committees.

Non-Executive Directors are required to attend 10-12 Board meetings per year (in Cambridge, Newtown and London or remote via telephone call) and to be available at other times as required for face-to-face and telephone meetings with the executive team and investors. In addition, they attend Board committee meetings as required.

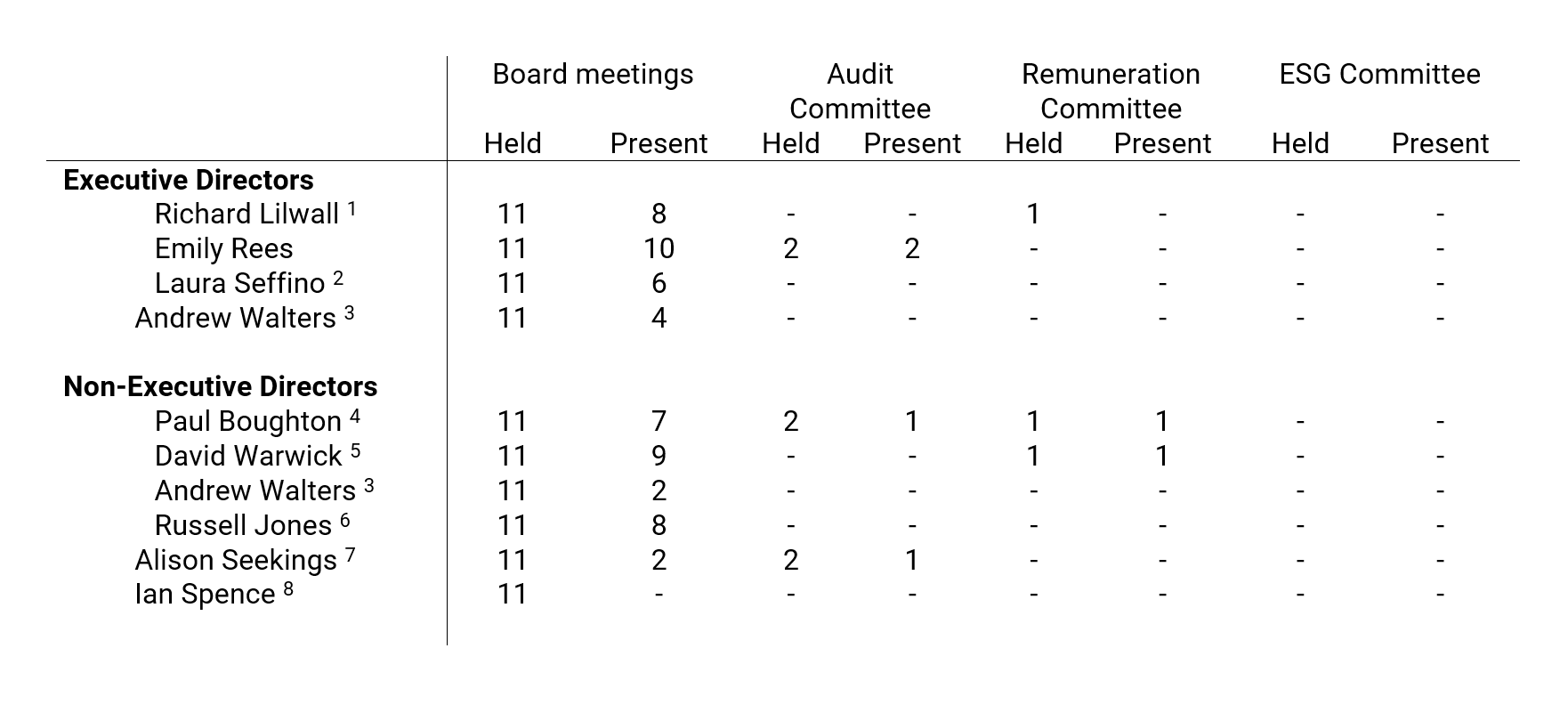

Meetings held during 2023 and the attendance of Directors is summarised below:

1 Richard Lilwall resigned from the Board in October 2023.

2 Laura Seffino resigned from the Board in July 2023, but has remained with the Company as a Quartix Limited Director.

3 Andrew Walters retired from the Board as Non-Executive Director in March 2023, and rejoined the Board as Non-Executive Chairman in September 2023, later becoming Executive Chairman on 10 October 2023

4 Paul Boughton resigned from the Board in September 2023

5 David Warwick resigned from the Board in November 2023

6 Russell Jones resigned from the Board in November 2023

7 Alison Seekings was appointed to the Board in November 2023

8 Ian Spence was appointed to the Board in February 2024

The Nominations Committee meets when required in relation to Board appointments.

The Board has a schedule of regular business, financial and operational matters, and each Board committee has compiled a schedule of work to ensure that all areas for which the Board has responsibility are addressed and reviewed during the course of the year. The Chairman is responsible for ensuring that, to inform decision-making, Directors receive accurate, sufficient and timely information. The Company Secretary, who is also the CFO, compiles the Board and committee papers which are circulated to Directors prior to meetings. The Company Secretary provides minutes of each meeting and every Director is aware of the right to have any concerns minuted and to seek independent advice at the Group’s expense where appropriate.

6. ENSURE THAT BETWEEN THEM THE DIRECTORS HAVE THE NECESSARY UP-TO-DATE EXPERIENCE, SKILLS AND CAPABILITIES

All members of the Board bring relevant sector experience in software and business services. The board at the reporting date have an aggregate 18 years of public company directorship experience, and two members are qualified accountants. The Board believes that its blend of relevant experience, skills and personal qualities and capabilities is sufficient to enable it to successfully execute its strategy. Where relevant, the Directors research relevant information, including online material, and occasionally attend seminars and trade events, to ensure that their knowledge remains current.

Key to committees/roles: E: Executive, N: Nomination, A: Audit, R: Remuneration, ESG: Environmental, Social & Governance, C: Chair

Andrew Walters, Executive Chairman (CESG, N, CR)

Background:

Andrew Walters founded Quartix in 2001 with three colleagues. Prior to that he was Managing Director of a subsidiary of Spectris plc for 6 years and had spent 15 years with Schlumberger in the UK and France, where he was Marketing Director of the payphones and smart cards division.

His financial involvement with Quartix is his annual Executive salary and he is a major shareholder in the Company so is not an independent Non-Executive Director.

Current external appointments:

Some voluntary business mentoring for The Prince’s Trust.

Skills and experience:

Andrew holds an MA in electrical sciences from the University of Cambridge and developed the Company’s UK patent, granted under the Patents Act 1977. He has many years’ experience of the vehicle tracking market, having started the company in 2001 with three colleagues, and has been fully engaged in all aspects of the business throughout this time.

Time commitment: 8 days a month

Emily Rees, Chief Financial Officer (ESG)

Background:

Emily Rees joined Quartix in 2021 and brings significant experience in operational and commercial finance across both private and public firms. Her previous role was Regional Head of Finance & HR for Western Europe for Ecco Shoes. Her global career includes senior financial positions within Pizza Express Limited and Tesco Stores Limited. Emily also heads up Quartix’s HR department.

Current external appointments:

Emily was a trustee and treasurer for two charities in 2023.

Skills and experience:

Emily is a member of the Chartered Institute of Management Accountants and holds a BSc (Hons) in Government and Economics from the London School of Economics and Political Science.

Time commitment: Full time

Alison Seekings, Independent Non-Executive Director (CA)

Background:

Alison is a senior finance leader with extensive experience of working at board level. She has worked in large professional services firms, formerly with Deloitte and then as a partner with Grant Thornton UK LLP until 2021. Alison has over 30 years’ experience of advising boards and supporting companies with their financial strategy and reporting requirements.

Current external appointments:

Alison is the founder of her own consultancy company called Seekings Advisory Limited and sits as a non-executive director for both Midwich Group plc and Green and Purple Limited. Alison is also CFO for RQ Biotechnology Limited.

Skills and experience:

Alison is a qualified chartered accountant and chartered tax adviser and has a degree in Natural Sciences from the University of Cambridge.

Time commitment: 1-2 days a month

Ian Spence, Independent Non-Executive Director (CN)

Background:

Ian has more than 25 years’ experience in researching and advising companies in the technology sector. Ian started his career in the City as a technology analyst working for, amongst others, Robert W Baird, WestLB Panmure and Bridgewell. He later went on to start Megabuyte, a leading company intelligence platform focusing on UK mid-market tech businesses, where he is currently Executive Chairman.

Current external appointments:

Ian’s other current roles include sitting as Non-Executive Director of Crown Place VCT PLC, a fund investing in early stage technology companies and as Principal at Agnosco Capital Ltd, where he provides research and strategic advice to technology companies and their investors.

Skills and experience:

Ian has been recognised as a highly respected financial analyst in the technology sector, having twice been voted as TechMARK Analyst of the Year and recognised by Debretts and The Sunday Times as a top 20 influencer in the UK technology sector. Ian has a degree in Accounting & Finance from Manchester Metropolitan University.

Time commitment: 1-2 days a month

7. EVALUATE BOARD PERFORMANCE BASED ON CLEAR AND RELEVANT OBJECTIVES, SEEKING CONTINUOUS IMPROVEMENT

A board evaluation process led by the Chairman was completed in 2022. This evaluation was accompanied by a wider review of the levels of investment in the business, as well the senior management posts required to deliver on its strategy.

8. PROMOTE A CORPORATE CULTURE THAT IS BASED ON ETHICAL VALUES AND BEHAVIOURS

At Quartix we believe the prosperity of our business and of the communities within which we operate requires a commitment to ethical values and behaviours. We have therefore developed policies that enhance all areas of our business in this regard.

Quartix cares about providing a customer experience that is remarkable. We want to keep our customers happy, impressed and reassured. We want to create the positivity that leads to great reviews, repeat purchases and customer referrals. To achieve that, our employees strive to make every interaction a great one. We follow these principles:

Build meaningful connections.

Whilst dealing with any of our stakeholders, be they customers, partners, investors or employees, foremost in our minds is building great, meaningful relationships. We are not a provider of arms-length transactional services; we are here to listen, understand, support and deliver tangible benefits as best we can.

Keep things simple.

Whether it is our processes, communication, hardware or software, we strive to keep things simple. Fewer moving parts make for clearer, more efficient and reliable operations. We don’t make our customers jump through hoops to speak to us, nor do we make them study an article to understand its meaning. We get straight to the incoming call, to the email in our inbox, to the point, and provide a fast, helpful and clear response.

Treat everybody the same.

Whoever you talk to, whether internally or externally, their impression of the Quartix service should be the same. We treat everyone equally, with respect, and remain transparent as a business.

Do the right thing

Quartix cares about doing what’s best for our customers and for each other. We own problems and solve them, regardless of whether it’s our designated responsibility. With or without a corporate process, we will strive to provide a satisfactory solution in every case.

Share your knowledge

Knowledge is valuable. Our customers, prospects and colleagues can all benefit from the knowledge that we have to offer. Quartix and its staff have a whole host of skills, expertise and experience to share with others and we are proud to do so.

The culture of the Group is characterised by these values which are communicated to staff through a number of mechanisms.

The Board believes that a culture that is based on the five core values is a competitive advantage and consistent with fulfilment of the Group’s execution of its strategy.

The culture is monitored through the use of Investors in Customers that surveys employee satisfaction on an annual basis. The Operations Board reviews the findings of the survey and determines whether any action is required.

9. MAINTAIN GOVERNANCE STRUCTURES AND PROCESSES THAT ARE FIT FOR PURPOSE AND SUPPORT GOOD DECISION-MAKING BY THE BOARD

The Board provides strategic leadership for the Group and operates within the scope of a robust corporate governance framework. Its purpose is to ensure the delivery of long-term shareholder value, which involves setting the culture, values and practices that operate throughout the business, and defining the strategic goals that the Group implements in its business plans. The Board defines a series of matters reserved for its decision and has delegated some of its responsibilities to Audit, Remuneration, Nominations and ESG Committees. The chair of each committee reports to the Board on the activities of that committee.

The Audit Committee monitors the integrity of financial statements, oversees risk management and control, monitors the effectiveness of internal controls and reviews external auditor independence.

Alison Seekings was appointed to Chairman of the Audit Committee following Paul Boughton’s resignation. The Audit Committee generally meets twice a year, as appropriate. The Committee exists to scrutinise and clarify any qualifications, recommendations and observations within the audited accounts and report of the Company’s auditor. When satisfied, the Committee presents the audited accounts and report to the Company’s Board and reviews the effectiveness of resultant corrective and preventative measures.

In performing this function, the key duties of the Committee are to:

- Monitor the integrity of the financial statements of the Group and any formal announcement relating to its financial performance

- With regards to financial reporting, review and challenge the consistency of accounting policies, the use of accounting methods over alternatives, whether the Group has followed appropriate accounting standards, the clarity of disclosure, and all material information relating to the audit and risk management

- Reviewing the basis for the going concern statement in light of the financial plans and reasonably possible scenarios especially considering industry wide factors that could impact the business such as inflationary pressures from the macro-economic effects of the Ukraine War.

- Monitor the adequacy and effectiveness of the Group’s internal financial controls, including the internal control and risk management systems. The Group’s Risk Register is reviewed at least twice a year by the main Board. A list of Matters Reserved for the Board was adopted in January 2016 including ensuring a sound system of internal control and risk management. All systems issues or unexpected outcomes are brought to the attention of the Board.

- Ensure that the Group’s arrangements for its employees and contractors to confidentially raise concerns about possible wrongdoing allow proportionate and independent investigation and appropriate follow up action.

- Consider the need to implement an internal audit function.

- Make recommendations to the Board and the Company’s shareholders regarding the appointment, re-appointment, and removal of the Company’s external auditor. It ensures that at least once every ten years the audit services contract is put out to tender to enable the Committee to compare the quality and effectiveness of the services provided by the incumbent auditor.

- Oversee the Company’s relationship with the external auditor.

- Considering if the Annual Report and Accounts, when taken as a whole, is fair, balanced and understandable.

The Remuneration Committee sets and reviews the compensation of Executive Directors including the setting of targets and performance frameworks for cash and share-based awards.

Andrew Walters chairs the Remuneration Committee following David Warwick’s resignation. It acts to ensure sound Corporate Governance with respect to Director and senior management remuneration and meets once or twice in the year, as appropriate. The Committee functions with the objective of attracting, retaining and motivating the executive management of the Company and ensuring they are rewarded in a fair and responsible manner for their contribution to the success of the Group.

The role of the Committee is to determine and agree with the Board the framework or broad policy for the remuneration of the Company’s Chairman and Executive Directors, including pension rights and compensation payments. It also recommends and monitors the level and structure of remuneration for senior management. When setting the remuneration policy, the Committee reviews and considers the pay and employment conditions across the Group, especially when determining salary increases.

The Nominations Committee

The Nominations Committee was chaired by Andrew Walters in 2023 following Paul Boughton’s resignation, and is now chaired by Ian Spence following his appointment to the Board. The Committee reviews the structure, size and composition of the Board to ensure the leadership of the Group is the most proficient to facilitate the Group’s ability to effectively compete in the marketplace. It makes recommendations to the Board regarding the continued suitability of any Director, the re-election by shareholders of any Director under the ‘retirement by rotation’ provisions in the Company’s Articles of Association, and succession planning for Directors and other Senior Executives.

The ESG Committee

Russell Jones led our first sustainability review in 2022, in order to better understand our environmental impact and to prioritise areas for action. Following his return to the plc Board, Andrew was appointed as Chair of the ESG Committee. The ESG Committee assesses our performance in Social and Governance matters, where it believes that Quartix already conforms to current best practice in most areas.

The Chairman has overall responsibility for corporate governance and in promoting high standards throughout the Group. He leads and chairs the Board, ensuring that committees are properly structured and operate with appropriate terms of reference, ensures that performance of individual Directors, the Board and its committees are reviewed on a regular basis, leads in the development of strategy and setting objectives, and oversees communication between the Group and its shareholders.

The CEO provides coherent leadership and management of the Group and leads the development of objectives, strategies and performance standards as agreed by the Board. He also monitors, reviews and manages key risks and strategies with the Board, ensures that the assets of the Group are maintained and safeguarded, leads on investor relations activities to ensure communications and the Group’s standing with shareholders and financial institutions is maintained, and ensures that the Board is aware of the views and opinions of employees on relevant matters.

At present Andrew Walters fulfils both the role of the Chairman and the CEO on the Board.

The Executive Directors are responsible for implementing and delivering the strategy and operational decisions agreed by the Board, making operational and financial decisions required in the day-to-day operation of the Group, providing executive leadership to managers, championing the Group’s core values and promoting talented management.

The Independent Non-Executive Directors contribute independent thinking and judgement through the application of their external experience and knowledge, scrutinise the performance of management, provide constructive challenge to the Executive Directors and ensure that the Group is operating within the governance and risk framework approved by the Board.

The Company Secretary is responsible for providing clear and timely information flow to the Board and its committees and supports the Board on matters of corporate governance and risk.

The key matters reserved for the Board are:

- Setting long-term objectives and commercial strategy.

- Approving annual budgets.

- Changing the share capital or corporate structure of the Group.

- Approving half-year and full-year results and reports.

- Approving dividend policy and the declaration of dividends.

- Ensuring a satisfactory dialogue with shareholders.

- Approving major investments, disposals, capital projects or contracts.

- Approving resolutions to be put to general meetings of shareholders and the associated documents or circulars.

- Approving changes to the Board structure.

The Board has approved the adoption of the QCA Code as its governance framework against which this statement has been prepared and will monitor the suitability of this code on an annual basis and revise its governance framework as appropriate as the Group evolves.

The Board will continue to monitor its governance structures and will take action as appropriate to develop and enhance its governance functions.

10. COMMUNICATE HOW THE COMPANY IS GOVERNED AND IS PERFORMING BY MAINTAINING A DIALOGUE WITH SHAREHOLDERS AND OTHER RELEVANT STAKEHOLDERS

In addition to the investor relations activities described previously, the following audit, remuneration and nominations committee reports were provided during 2023:

Audit Committee Report

During 2023 the committee met formally twice and had other discussions (including the impairment for Konetik and provision for the replacement of 2G units in France) as required, and the external auditor and CFO were invited to attend the formal meetings. The Audit Committee continued to focus on the effectiveness of the controls throughout the Group.

Consideration was given to the auditor’s pre and post-audit reports and these provide opportunities to review the accounting policies, internal control and the financial information contained in the annual report.

Remuneration Committee Report

The remit of the Remuneration Committee is to determine the framework, policy and level of remuneration, and to make recommendations to the Board on the remuneration of Executive Directors. In setting remuneration packages, the committee ensured that individual compensation levels, and total board compensation, were comparable with those of other AIM-listed companies. In addition, the committee oversees the creation and implementation of all-employee share plans.

The Remuneration Committee during 2023 consisted of Paul Boughton, David Warwick and Richard Lilwall until their Directorships ended at which point Andrew Walters became the sole member and therefore Chair of the Remuneration Committee. The committee met once.

Nomination Committee Report

The remit of the Nomination committee is to evaluate potential Board appointments against the skills and experience which the Board requires. It meets as required for this purpose.

The Nomination committee was chaired by Andrew Walters in 2023 following Paul Boughton’s resignation, and is now chaired by Ian Spence following his appointment to the Board.

ESG Committee Report

The remit of the ESG committee is to ensure the effective operation of a company’s ESG policy, and delegated responsibility for overseeing its implementation. The committee reviews data from across the business and then filters and summarises it for the board. It meets as required for this purpose.

The ESG committee was chaired by Russell Jones until his resignation, at which point Andrew Walters was appointed as Chair, Emily Rees is also a member of the ESG Committee.

Shareholders should be wary of any unsolicited investment advice and offers to buy shares at a discounted price. These fraudsters use persuasive and high-pressure tactics to lure shareholders into scams.

Please keep in mind that firms authorised by the FCA are unlikely to contact you out of the blue with an offer to buy or sell shares. You should consider getting independent financial or professional advice before you hand over any money.

If you suspect you have been approached by fraudsters, please contact the FCA using the share fraud reporting form available at www.fca.org.uk/scams.

You can also report suspected share fraud through the FCA Helpline (see the FCA website for details).

Contact us

Investor relations

Call 01686 806 663

Andy Walters

Executive Chairman

Investor information is set out in accordance with AIM rule 26